Irs vehicle depreciation calculator

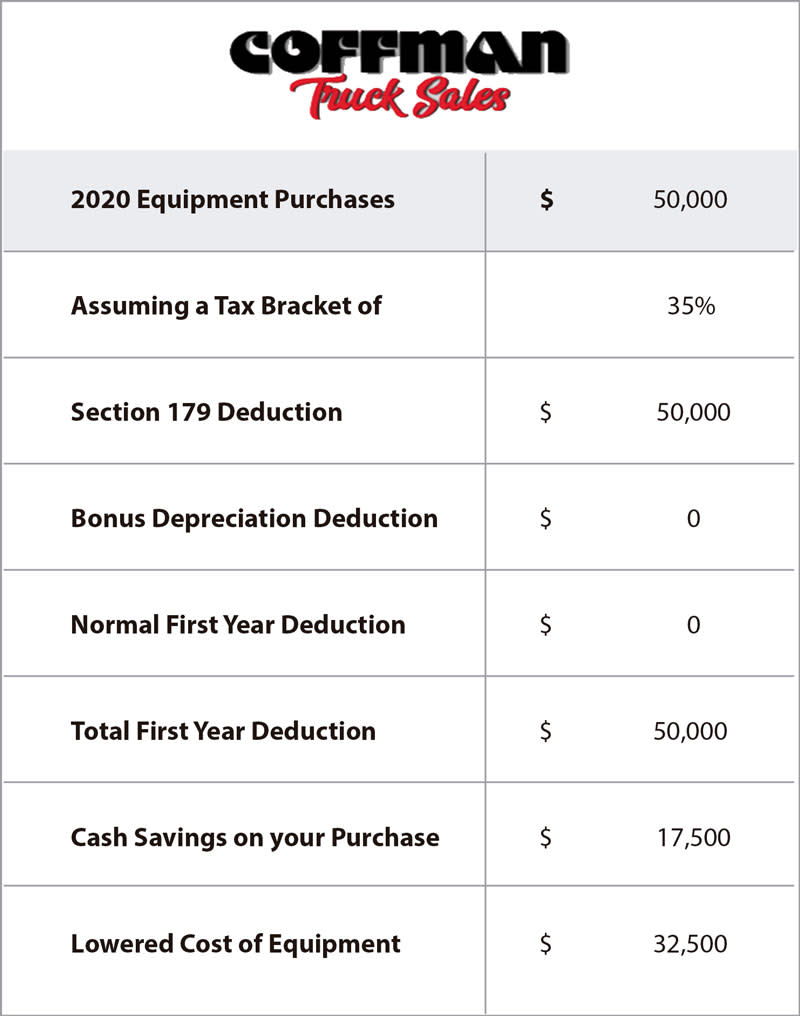

Simply multiply the cost of the equipment vehicles andor software by the percentage of business-use to arrive at the monetary amount eligible for Section 179. Assets are depreciated for their entire life allowing printing of past current and.

Automobile And Taxi Depreciation Calculation Depreciation Guru

The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

. Depreciation limits on business vehicles. 2020 Tax Returns were able to be e-Filed up until October 15 2021. Depreciation for 2009 using Table A-1 is 100 million 20 20 millionDepreciation in 2010 100 million - 20 million 15 200 32 millionDepreciation in 2010 using Table 100 million 32 32 million.

Their findings demonstrated that the temperature inside a car can increase by 40 degrees Fahrenheit on average over the course. According to the IRS depreciation starts as soon as the property is placed in service or even available to use as a rental property. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Use the 2020 Tax Calculator to estimate your 2020 Return.

See three lines below for additional vehicle depreciation Line 13. Scholars at the Stanford University School of Medicine performed a study in which they investigated the rate at which the interior temperature of a parked car increased during sunny days of temperatures between 72 and 96 degrees Fahrenheit. January 1 - December 31 2020.

Deemed first-year bonus depreciation the Tax Cuts and Jobs Act temporarily increases the bonus depreciation percentage from 50 to 100 for qualified property placed in service after Sept. MACRS Depreciation Calculator Help. The Car Depreciation Calculator uses the following formulae.

Also businesses with a net loss in a given tax year qualify to carry-forward the. Remember that residential rental property is. In the example above your depreciation on an auto would be limited to the business-use percentage of 90 times the maximum 2021 first-year maximum of.

A P 1 - R100 n. Above is the best source of help for the tax code. To calculate the impact of depreciation compare an example for a commercial truck worth 100000.

If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. If you use the actual expenses method and the vehicle was acquired new in 2021 the maximum first-year depreciation deduction including bonus depreciation for an auto in 2021 is 18200. Assume a depreciation rate of 30 after the first year and 20 each consecutive year.

The First Time Homebuyer Credit Account Look-up IRSgovhomebuyer tool provides information on. You can use a double-declining calculator. MACRS ACRS 150 200 Declining Balance Straight-Line Sum-of-the-Years-Digits Vehicles Amortization Units of Production and Non-Depreciating asset methods are all available.

The book value is the assets cost minus the. Since that date 2020 Returns can only be mailed in on paper forms. Also you can try the vehicle depreciation calculator to know the depreciated expense for your vehicle.

The average car depreciation rate is 14. IRS Income Tax Forms Schedules and Publications for Tax Year 2020. What Are the Most Common Methods of Depreciation.

Calculator and Quick Reference Guide. You bought a 40000 Toyota for business use and want to claim a tax deduction on this asset. See IRSgov for details.

Thus it is useful to very large businesses spending more than whatever Section 179s spending limit is for that year. When you buy an asset like a. Here the vehicle you originally paid 100000 for is worth only 28672 after five years not even 30 of its initial value.

Bonus Depreciation is taken after the Section 179 deduction is taken. The first chart the MACRS Depreciation Methods Table tells you your Toyota is a non-farm 3- 5- 7- and 10-year property and that you use the GDS 200 method to calculate how much tax to deduct. Depreciation IRS Form 1120S Line 14 Only add back the eligible Other line items such as Amortization or a non-recurring.

Star Software Fixed Asset Depreciation provides for Book Tax Alternate ACE and Other State depreciation. The equipment vehicles andor software must be used for business purposes more than 50 of the time to qualify for the Section 179 Deduction. You consult the IRS MACRS Depreciation Tables.

D P - A. MACRS declining balance changes to straight-line method when that method provides an equal or greater deduction. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase.

Depreciation can affect the value of your assets and your taxes often for several years. Form 91 Income Calculations. The IRS Withholding Calculator IRSgovw4app estimates the amount you should have withheld from your paycheck for federal income tax purposes.

Irs Announces Luxury Auto Depreciation Caps And Lease Inclusion Amounts Doeren Mayhew Cpas

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Free Macrs Depreciation Calculator For Excel

Accounting For Rental Property Spreadsheet Income Statement Statement Template Profit And Loss Statement

7 Fishbone Diagram Templates Pdf Doc Diagram Excel Templates Templates Printable Free

Section 179 Deduction Hondru Ford Of Manheim

Macrs Depreciation Calculator With Formula Nerd Counter

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

1 Free Straight Line Depreciation Calculator Embroker

What Is An Account Holder Definition Overview 4 Facts In 2022 Accounting Business Bank Account Credit Card Account

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Automobile And Taxi Depreciation Calculation Depreciation Guru

Section 179 Tax Deduction Coffman Truck Sales

Macrs Depreciation Calculator Irs Publication 946

How To Calculate Depreciation Expense For Business

Macrs Depreciation Calculator Based On Irs Publication 946

Section 179 For Small Businesses 2021 Shared Economy Tax